Current Status and Prospects of the Machine Vision Industry

China's machine vision industry is experiencing rapid growth by 2025, with a market size projected to exceed 21 billion yuan. The integration of 3D vision and AI will become a core growth engine, with widespread application in the automotive, semiconductor, and new energy sectors. Technological iteration and domestic substitution are accelerating, and the industry is expected to achieve an average annual growth rate of 21.2% over the next five years.

Industry Current Status and Market Size

Market Size and Growth

In 2024, China's machine vision market size will be 18.147 billion yuan (according to the China Business Industry Research Institute) or 39.54 billion yuan (according to CMVU), with the difference due to different statistical calibers. By 2025, it is projected to exceed 21 billion yuan (according to China Business Research Institute) or 58.08 billion yuan (according to CMVU), with an average annual growth rate of 21.2%. This growth is driven by surging demand in the automotive, semiconductor, and new energy (lithium battery and photovoltaic) sectors. The automotive manufacturing vision market is expected to reach 3.11 billion yuan in 2024, with a compound annual growth rate of 35.2%.

Application Distribution

3C electronics (22.32%), automotive (12.97%), and semiconductors (10.74%) are the top three application areas, with penetration rates rapidly increasing in emerging sectors such as pharmaceuticals, photovoltaics, and logistics.

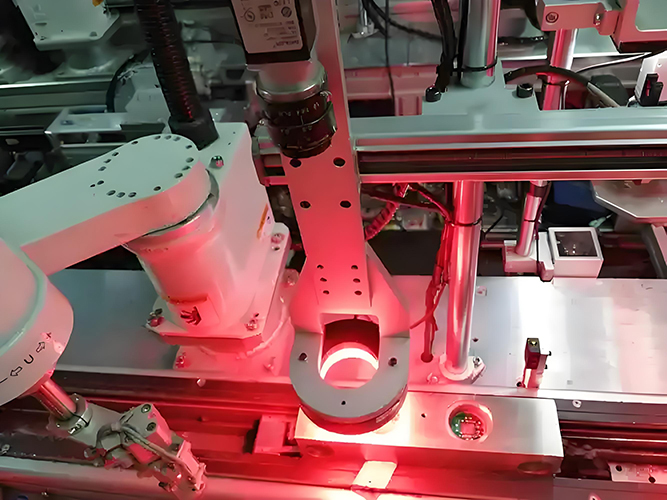

Typical Case: Fujian Fufashi Co., Ltd. uses an AI quality inspection system to achieve a false detection rate of less than 0.02% for fabric defect identification; a new energy vehicle battery factory uses 3D vision technology to control welding precision. 23

Technology Development Trends

3D vision replaces 2D technology

Technologies such as structured light and Time of Flight (ToF) have matured, and domestically produced 3D cameras have achieved an accuracy of ±0.05mm and a recognition rate of 99.2% in bright light environments (Migration Technology's Epic Eye series). The global 3D smart camera market is expected to exceed US$4.8 billion in 2025, with a 68% penetration rate in the manufacturing industry.

Multimodal Fusion

Deep learning algorithms reduce the number of defect detection samples from tens of thousands to dozens (Lingyun Optical Technology), and edge computing achieves millisecond response times. New technologies such as hyperspectral imaging (West Lake Intelligent Vision) and event cameras are expanding into non-industrial applications such as agriculture and healthcare.

Breakthrough in Domestication.

The domestic production rate for light sources and lenses exceeds 85%, but high-end sensors (such as CMOS) still rely on imports (domestic production rate is 35%). Companies such as Hikvision Robotics and Optoelectronics dominate the midstream market.

Future Outlook

Policy and Market Drivers

The 14th Five-Year Plan lists machine vision as a key technology for intelligent manufacturing, and China is expected to account for 30% of the global market share by 2030.

Emerging fields such as humanoid robots and autonomous driving will drive demand for 3D vision (the humanoid robot market is expected to reach 305 billion yuan in 2030).

Technology Evolution Direction

Upgrading from "perceptual intelligence" to "cognitive intelligence," combining brain-inspired computing and photonic chips to achieve higher precision and energy efficiency.

The trend toward miniaturization is driving the popularization of consumer applications (such as AR/VR and wearable devices).